PEANUT CLUSTER

The Peanut Cluster is an entire chain, including related chains. It is a group of interrelated businesses engaging in different activities with a shared goal.

The Cluster

The Peanut Cluster is made up by exporters, farmers, shipping and logistics companies, laboratories, service providers and metalworking industries.

Every company is centered on different businesses that work towards the final outcome: peanut exports.

The Peanut Cluster is the only one where farmers are effectively integrated into industry and exports, in an almost perfectly synergistic chain. Unlike other agricultural sectors, peanut farmers partner in cooperatives, which, in turn, own their industrial facilities and export operations, or otherwise hold partnership agreements with industrial businesses.

REGIONAL ECONOMY

The Peanut Agro-industrial Sector chiefly extends across the Province of Córdoba and constitutes a flagship regional economy, centered almost exclusively on exports, since 95% of their production is exported (CAM statistics from 2014 data).

Peanuts are to the Province of Córdoba what vineyards are to Mendoza or sugar cane to Tucumán.

LABOR AND THE IMPACT OF THE PEANUT INDUSTRY

The economies of approximately thirty districts in the interior of Córdoba thrive on peanut agro-industry as the sole significant source of employment.

The Peanut Cluster accounts for close to 12,000 jobs, direct and indirect, in said locations. Hundreds of jobs are linked to the production and marketing sectors of pesticides, specific farming and industrial equipment and machinery manufacturing, quality control laboratories and cargo certification, quality assurance and certification services for products and processes, shipping and multimodal cargo transportation companies, engineering consultants and agro-industrial technology for peanuts, equipment and professionals for scientific and technological research, construction companies, and different communications and IT services supporting the Peanut Agro-Industrial Sector.

Also worth highlighting is the almost vital role of every company in the life of their community, by supporting the operation of schools, law enforcement, fire fighters, hospitals and road construction consortia, which also enables significant retention of youths in their places of origin.

EXPORTS

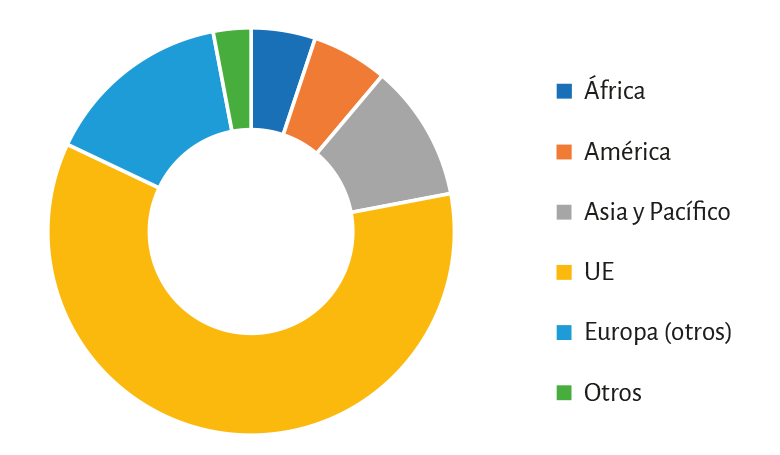

The commercial initiatives that the companies of the Peanut Cluster have undertaken enabled the development of new markets for Argentine exports, totaling more than 106 destination countries.

The peanut sector, in pursuit of new markets, has specialized in the operation and legislation of imports of the destination countries, relying on a quality assurance system unparalleled by any other origin in the world.

Argentina has consolidated its standing as the main peanut supplier of the European Economic Community and a worldwide quality leader.

2020 Exports by Area (Million USD).

(Excluding oil and expeller)

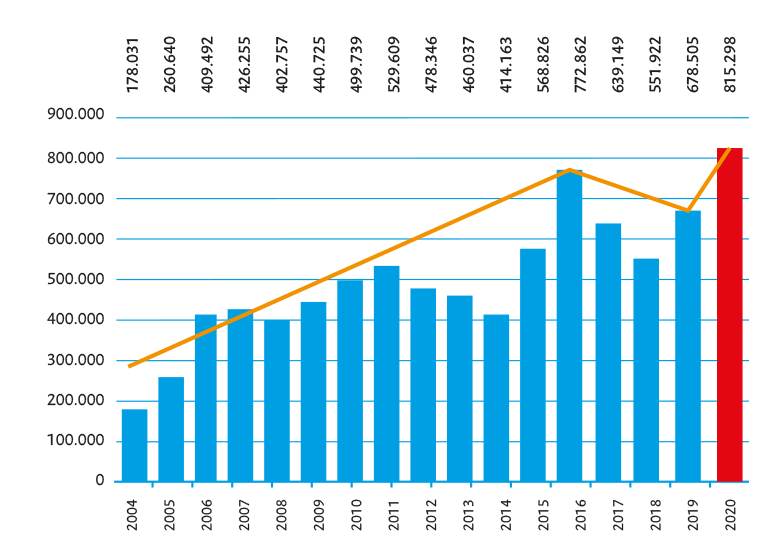

Evolution of Exports

Export volume, once cyclical and concentrated in certain months of the year, is presently less seasonal and distributed across the year, resulting from the investment in cold storage facilities and the adoption of varieties with high oleic acid content, which grants the finished product a longer shelf life.

Peanuts accounted for more than 10% of the total exports of the Province of Córdoba in 2012, reaching export volumes in excess of 1 billion dollars. Such volume equaled 1.5% of total grain exports from Argentina in 2013.

Due to different climate, market and cyclical conditions of international markets, the export volumes of the sector have dropped by an overall 22% in the last four years.

All the efforts undertaken, and mainly, the excellence of their products, have allowed the sector to sustain a price advantage that -despite the variations in the planted areas and the drop in export volumes- increased revenues for the country, featuring 14.8% growth of activities as from 2008, according to INDEC (National Statistics and Census Institute) statistics.

Evolution of Exports in Volume: 2004-2020